Even though it has been over 50 years since the Fair Housing Act was passed, Black homeownership rates have only risen from 41.8 percent to 42.3 percent from 1970 to 2019 (see Figure 1). The same data shows an increase of at least 10 percent for White, Hispanic/Latino, and Asian Americans from that same period.*

Figure 1

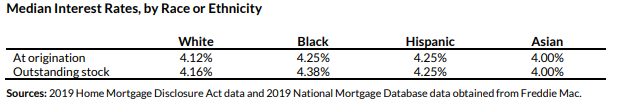

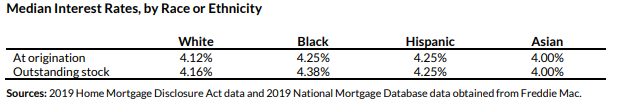

For the last century, there has been a homeownership gap between Black and White Americans specifically of between 20 and 30 percent. With the COVID-19 pandemic, the gap has increased, and conditions have worsened significantly for Black homeowners.

Figure 2

Next Steps

The Department of Housing and Urban Development (HUD) has a plan to combat this disparity and has promised to dramatically increase the number of Black homeowners by 2030. Over 100 housing groups signed on to support the effort.

HUD helps to protect the housing rights of all Americans; acts of discrimination are taken very seriously and investigated thoroughly at the State and Federal levels. With the continued diligence of all parties in the housing industry, we can ensure that housing is equally available to all Americans regardless of race or other superficial factors.

Kwik Mortgage

Kwik Mortgage is proud to be an Equal Opportunity Lender. We comply with all federal and state guidelines including regular internal audits of our loans to ensure we do not have any disparities. It is important that we prioritize fair and equitable lending practices so that we remain a part of the solution.

* Figures 1 and 2 via NPR’s Black Americans and the Racist Architecture of Homeownership.