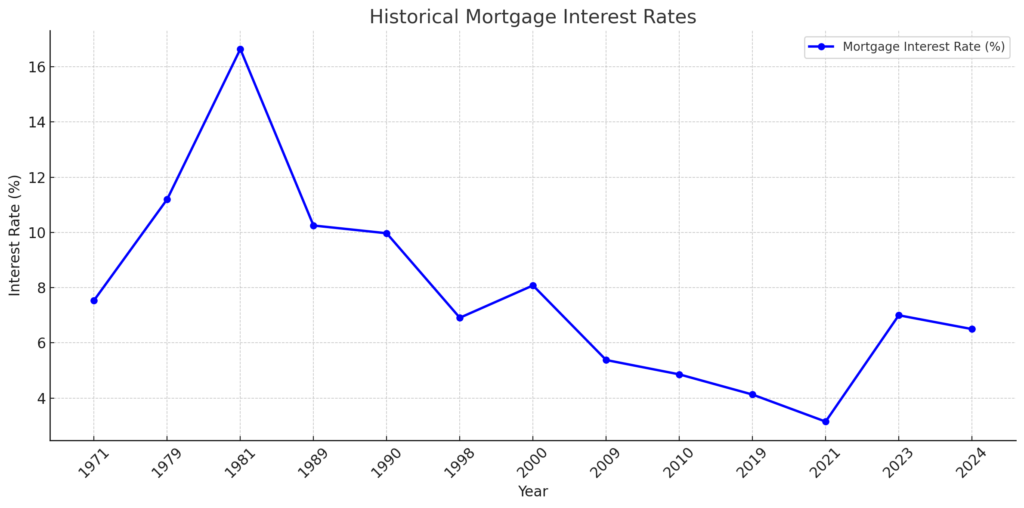

Mortgage rates have changed dramatically over the past five decades, reflecting broader economic trends, government policies, and global events. From the high rates of the 1980s to record lows in recent years, understanding mortgage rate history helps explain the housing market’s evolution and provides insight into future trends. This guide takes you through mortgage rate trends from the 1970s to 2024, showcasing how these fluctuations have shaped the landscape for homebuyers.

1970s: Rising Inflation and Steady Rate Increases

In the 1970s, mortgage rates steadily increased due to inflation and economic challenges. Early in the decade, rates were manageable, but by the end of the 1970s, they had climbed significantly.

- Rate Range: Rates rose from around 7.54% in 1971 to 11.20% by 1979.

- Impact on Buyers: Higher rates reduced affordability and made homeownership more challenging as the decade progressed.1980s: Peak Rates and Economic Recession

The 1980s saw the highest mortgage rates in U.S. history. To control the surging inflation, the Federal Reserve, led by Chairman Paul Volcker, raised interest rates aggressively. While this strategy curbed inflation, it caused mortgage rates to skyrocket.

- Peak Rates: Mortgage rates peaked at 16.64% in 1981 before gradually declining to 10.25% by 1989.

- Impact on Buyers: Many buyers struggled to afford homes, resulting in a decline in home sales and refinancing options. However, the later part of the decade saw rates drop, offering slight relief.

1990s: Economic Growth and Rate Declines

The 1990s marked a period of economic growth and stability, with inflation under control. This allowed mortgage rates to steadily decrease, making homeownership more attainable.

- Rate Range: Rates dropped from 9.97% in 1990 to 6.91% by 1998.

- Impact on Buyers: Lower rates encouraged homeownership, fueling a housing boom. Adjustable-rate mortgages (ARMs) also became more popular, offering flexibility for buyers.

2000s: Housing Boom, Crisis, and Recovery

The early 2000s saw relatively low rates, fueling a housing boom as buyers capitalized on affordable mortgages. However, the 2008 financial crisis drastically changed the landscape, leading to economic challenges and stricter lending standards.

- Rate Range: Rates were around 8.08% in 2000 but dropped to 5.38% by 2009 as the Federal Reserve sought to stimulate the economy post-crisis.

- Impact on Buyers: Low rates initially encouraged buying, but the crisis highlighted the risks of subprime lending. In the years following, both buyers and lenders adopted a more cautious approach.

2010s: Record Lows and Economic Recovery

In the 2010s, the Federal Reserve kept rates low to support recovery from the Great Recession. Mortgage rates reached record lows, helping more people afford homes and refinance existing mortgages.

- Rate Range: Rates stayed below 4.86% in 2010 and reached as low as 4.13% by 2019.

- Impact on Buyers: These historically low rates encouraged both first-time buyers and refinancers, contributing to a stronger housing market recovery. Homeownership became more accessible, leading to increased demand and price appreciation.

2020s: Pandemic, Historic Lows, and Rising Rates

The COVID-19 pandemic initially drove mortgage rates to unprecedented lows as the Federal Reserve implemented measures to support the economy. However, as inflation surged in the early 2020s, the Fed began raising rates, leading to an increase in mortgage rates.

- Pandemic Low: Rates dropped to 3.15% in 2021, the lowest in U.S. history.

- Recent Trends: By 2023, rates had risen to around 7.00% due to inflation and economic shifts.

- Impact on Buyers: The early 2020s made homeownership highly affordable, but the recent rate hikes have slowed the housing market, with higher rates impacting affordability for new buyers.

2024: Stabilization and Current Trends

In 2024, mortgage rates have leveled off in the 6% to 7% range as inflation pressures persist. The Federal Reserve’s interest rate policies and economic factors continue to influence the market, and while rates are higher than the record lows of recent years, they remain manageable compared to historical peaks.

- Current Rate Range: Approximately 6% to 7% in 2024.

- Impact on Buyers: Today’s rates have prompted buyers to reassess budgets and consider creative financing solutions. While rates are higher than in previous years, they are still far below the highs of past decades.

Conclusion

The history of mortgage rates from the 1970s to 2024 reveals the interplay between economic forces, government policies, and global events that have shaped the cost of borrowing for homebuyers. By understanding these trends, buyers today can better navigate the current market and anticipate possible rate movements in the future. Whether buying a first home or refinancing, tracking mortgage rate trends offers valuable insights for making informed financial decisions.